Bessent Says Clarity Act Could Tame Bitcoin Swings as Coinbase Resists Stablecoin Yield Limits

Treasury Secretary Scott Bessent argues the Clarity Act would calm crypto volatility; Coinbase withdraws support over stablecoin yield limits. Prediction markets see a 62% chance by 2026.

Because Bitcoin

February 14, 2026

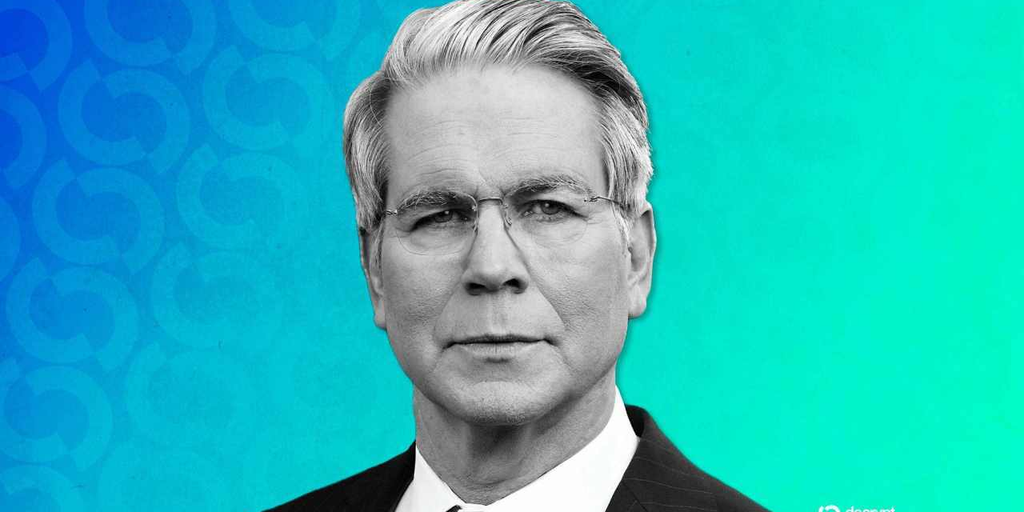

U.S. Treasury Secretary Scott Bessent is leaning into a simple thesis: policy uncertainty is a volatility amplifier. With Bitcoin off more than 29% in the past month and both BTC and ETH well below last year’s highs, he told CNBC that passing the Clarity Act—the crypto market structure bill—would settle nerves and he wants it on the president’s desk this spring. He also framed the past month’s turbulence as partly “self-induced,” citing crypto companies, including Coinbase, that oppose the bill’s current text. Prediction markets currently assign roughly a 62% chance that the bill is signed into law by the end of 2026.

The tension centers on the cost of imperfect clarity. Coinbase withdrew support after language emerged that would restrict consumer-facing yield on stablecoins. CEO Brian Armstrong has said he’d rather see no bill than accept a flawed framework. Bessent, meanwhile, has escalated his public pressure: in recent days he’s labeled bill opponents nihilists and suggested they decamp to El Salvador, and over the weekend he described them as recalcitrant actors. He has also warned that if Democrats win the House in this year’s midterms, negotiations could break down, arguing that the party’s approach to crypto under the Biden administration was close to an extinction event for the industry.

Here’s the crux: markets usually price a policy risk premium when the rules of the game feel malleable. A comprehensive market structure bill, even if imperfect, can compress that premium by clarifying jurisdiction, licensing, and permissible products. In practice, you tend to see realized volatility ease, funding and basis normalize, and capital move from the sidelines once compliance pathways are legible. That’s the “comfort” Bessent is after.

The pushback on stablecoin yield is not cosmetic. Consumer yield products are a meaningful, repeatable revenue stream for exchanges and fintechs. Capping or prohibiting them could shift business models toward transaction-heavy lines, custody, or institutional services—areas with lower operating leverage and tougher competition. From a risk lens, curbing retail stablecoin yield trims hidden leverage and rehypothecation chains that sometimes mask counterparty exposure. From a product lens, it may also blunt innovation on on-chain money markets that many builders view as core to crypto’s utility layer. That’s the trade: shrink tail risk versus slow certain forms of composability.

Investors are responding to the rhetoric as much as the text. A Treasury that publicly spars with major incumbents introduces a signaling effect—some allocators interpret it as antagonism, others as a willingness to finally land the plane on rules. If Bessent delivers a spring timeline, you could see an interim relief bid in beta assets and a narrowing of risk spreads across centralized venues. If the calendar slips into the midterm window and the House flips, the probability tree changes, and so does the market’s path: more chop, episodic squeezes, and higher sensitivity to enforcement headlines.

On balance, I see three scenarios worth gaming: - Swift passage this spring: policy risk premium compresses; BTC and ETH vol cools; stablecoin issuers and exchanges pivot roadmaps toward compliance-grade features; yield migrates to institutional-only channels. - Prolonged stalemate into late 2026: liquidity stays fragmented; builders ship cautiously; valuation multiples carry a policy discount; volatility remains elevated on regulatory soundbites. - Compromise amendment on stablecoin yield: a capped, disclosure-heavy retail yield emerges; Coinbase and peers re-engage; diffusion of innovation continues with clearer guardrails.

Bessent’s calculation is that the market will accept imperfect guardrails in exchange for predictability. Coinbase’s bet is that accepting the wrong guardrails hard-codes a ceiling on product innovation—especially around stablecoin cash flows. Both can be rational. The market’s job is to discount which path is more likely; for now, Polymarket’s 62% odds and the spring target set the near-term narrative. Until that resolves, Bitcoin’s volatility won’t just be about macro; it will be a referendum on whether Washington can price clarity faster than the industry can price fear.