Cango Offloads $305M in Bitcoin, Retires BTC-Backed Debt to Power AI Pivot

Bitcoin miner Cango sold 4,451 BTC for $305M, paid down BTC-collateralized debt, and hired an ex‑Zoom CTO to drive an AI compute push—while keeping its mining business online.

Because Bitcoin

February 10, 2026

Cango just chose balance sheet clarity over balance sheet bravado. The Dallas-based Bitcoin miner unloaded 4,451 BTC over the weekend—roughly $305 million—and used the entire haul to pay down a portion of a Bitcoin‑collateralized loan. The move clears financial drag as the company redirects its grid-connected footprint toward supplying distributed compute for artificial intelligence, while it continues to mine BTC.

Shares slipped nearly 3% on the day to trade below $0.95 and remain down 62% over six months. Cango also named Jack Jin, previously at Zoom, as CTO to build out the AI line of business. The company says it operates more than 40 sites across four geographic regions.

Operationally, the ramp started in January: Cango mined nearly 500 BTC, sold 550 BTC (about $39 million), and ended the month with 7,474.6 BTC—approximately $528 million at month-end pricing. CEO Paul Yu signaled an ongoing shift in treasury management: beginning this month, the firm will selectively sell a portion of newly mined Bitcoin to fund its inference platform and other near-term growth initiatives, citing the need for tactical flexibility. A company representative did not respond to a request for comment.

What matters here is the capital allocation signal. Miners often get trapped by their own beta: when BTC runs, treasuries look genius; when volatility bites, collateralized loans magnify downside. By monetizing a slice of its stack to unwind BTC‑backed leverage, Cango reduces reflexive risk and converts a volatile asset into operating runway. That improves optionality for an AI pivot where revenue ramps depend on utilization, contract duration, and the mix of inference versus training workloads.

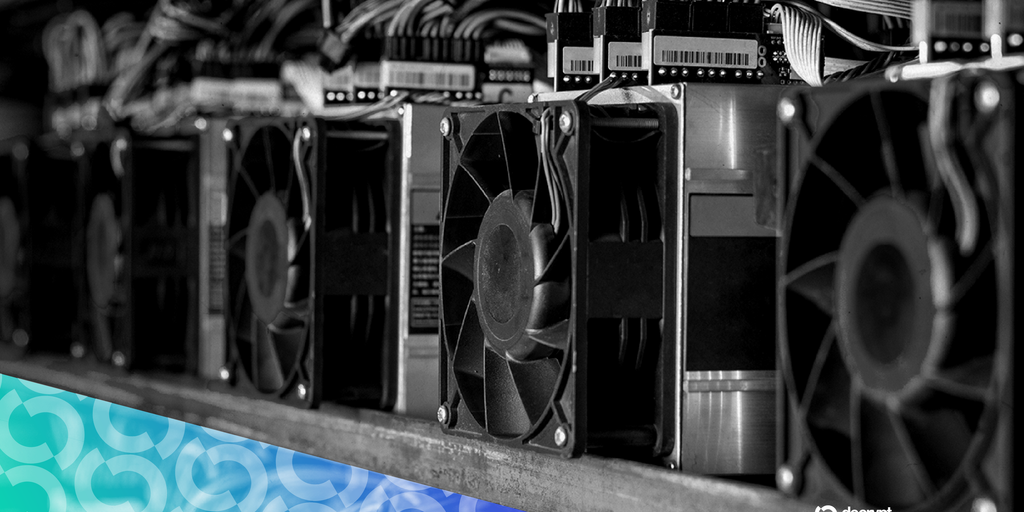

On the tech and infrastructure side, miners have a comparative edge: power, cooling, and 24/7 operations already tuned for ASIC fleets can be retooled for GPUs serving inference. The economics are different—workload density, networking, and SLAs matter more than raw hashrate—but the site control and grid interconnects are valuable primitives. The appointment of a CTO with large-scale software experience hints at a plan to stitch hardware, orchestration, and customer contracts into a cohesive platform rather than a one-off hardware flip.

Investors, meanwhile, tend to punish ambiguity. A near-term share dip reflects skepticism around execution risk and the identity shift many miners are navigating. Selling BTC can read as capitulation to some, but hoarding coins while carrying BTC‑collateralized debt is a fragile equilibrium. Cango’s guidance to keep mining while optimizing hashrate scale and efficiency—and to use a disciplined asset allocation framework—will be judged by concrete KPIs: AI compute utilization, cash yield per megawatt, and the cadence of additional BTC sales.

There’s also a systems trade-off to watch. Redirecting energy and capex from ASICs to GPUs may improve returns if AI demand stays tight, yet over-indexing on short-duration inference contracts could leave facilities exposed if pricing compresses. Ethically, expanding compute footprints on shared grids raises familiar questions about local power markets and workload prioritization; operators that actively balance grid stability tend to secure more durable community and regulatory support.

For BTC itself, the sale is a drop in deep liquidity, but the message is louder than the flow: more miners are treating Bitcoin as working capital rather than sacred treasury. If that discipline holds, miner equities could trade more like infrastructure providers and less like levered BTC trackers.

Market context: Bitcoin is down around 0.2% over 24 hours at $70,727, nearly 10% lower on the week and 44% below its October all-time high of $126,080, after bouncing from a dip near $60,000 last week. Cango’s next test is straightforward—turn balance sheet cleanup and a CTO hire into sustained, contracted AI compute revenue while protecting mining economics.