CME Group Unveils Intentions for Own Spot Bitcoin Trading Platform: FT

As the world's largest futures exchange, CME Group holds a commanding position in the Bitcoin futures market, accounting for nearly a third of all open Bitcoin futures contracts. Their potential foray into spot trading could serve as a catalyst for a significant influx of new capital into the cryptocurrency space.

Bitcoin

Trading

News

Because Bitcoin

May 16, 2024

Bitcoin

Trading

News

Financial Times has reported that the CME Group (The world's leading futures exchange) is considering launching a platform for buying and selling bitcoin directly (spot trading). This move aims to capitalize on the growing interest from Wall Street money managers who are looking for ways to invest in cryptocurrency.

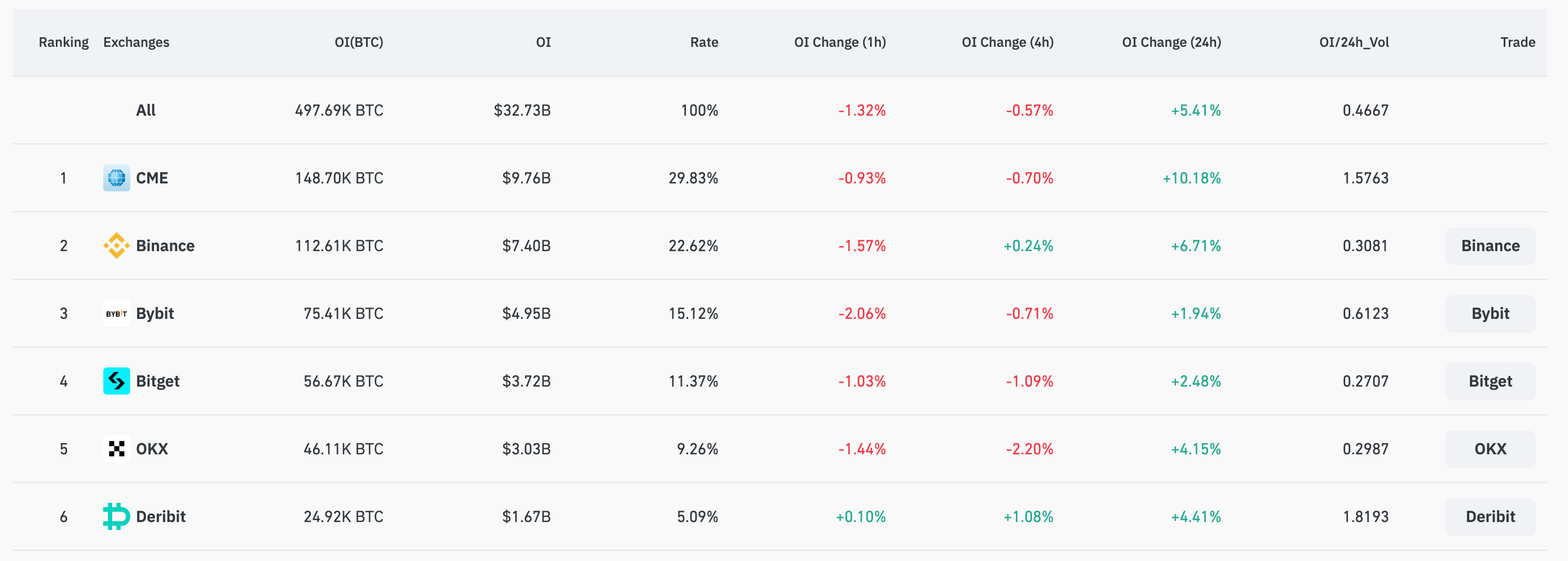

As the world's largest futures exchange, CME Group holds a commanding position in the Bitcoin futures market, accounting for nearly a third of all open Bitcoin futures contracts. Their potential foray into spot trading could serve as a catalyst for a significant influx of new capital into the cryptocurrency space.

Discussions are underway with traders who want a regulated marketplace for bitcoin transactions. This potential expansion would follow the SEC's approval of Bitcoin investment options in stock market funds earlier this year.

Benefits for Established Players:

- Easier "Basis Trading": Spot trading would complement CME's existing bitcoin futures market, allowing investors to employ basis trades. This strategy involves buying bitcoin while simultaneously selling futures contracts to profit from price discrepancies.

- Institutional Interest on the Rise: Major financial institutions are warming up to bitcoin after its impressive rise and regulatory crackdowns on illegal activity in the crypto market. Despite a recent price dip, Bitcoin ETFs are attracting significant investments.

CME Capitalizes on the Trend:

- Surpassing Binance: CME has become the top venue for bitcoin futures trading, surpassing Binance. This growth is fueled by institutional investors seeking to manage bitcoin's volatility.

Source

- Potential Business Model: CME's spot trading, if launched, would likely operate through their Swiss subsidiary, EBS, which boasts robust crypto asset regulations.

Challenges and Considerations:

- Split Market Concerns: Some experts question the efficiency of having separate markets in Chicago and Switzerland.

- Benefits Beyond Trading: However, they acknowledge that established exchanges entering the space legitimizes the infrastructure for secure crypto trading and opens doors for innovative collateral options using crypto-related assets.