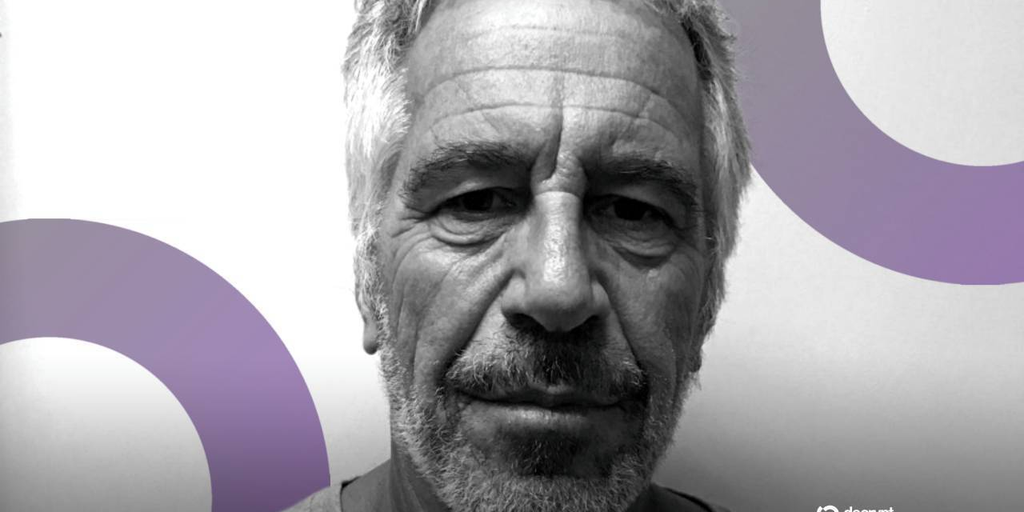

Inside the Epstein Files: How Elite Gatekeepers Shaped Early Bitcoin Capital

DOJ-released Epstein records reveal early Coinbase and Blockstream bets, emails with Thiel and Bannon, and ties to Brock Pierce—spotlighting crypto’s reputational risk circuitry.

Because Bitcoin

February 8, 2026

The newly released Department of Justice records on Jeffrey Epstein surface thousands of crypto references, and together they sketch a single throughline: Bitcoin’s formative years were not just code and markets—they were also social capital, reputation management, and access. The files, published in two batches and drawn from millions of documents, place well-known builders, investors, and institutions inside Epstein’s orbit. The details matter, but the pattern matters more: early crypto’s funding rails often ran through power networks that create lasting governance and brand risk.

Early placements show the point. Emails indicate Epstein put $3 million into Coinbase in 2014 after being introduced to the deal by Tether co-founder Brock Pierce and his firm, Blockchain Capital. Blockchain Capital told investigators he ultimately invested independently, not via the fund. Coinbase co-founder Fred Ehrsam was aware of the check, which landed when the exchange was reportedly valued near $400 million. Epstein later sold roughly half of his position back to Blockchain Capital in 2018. Coinbase is now a public company worth about $44 billion. That arc captures how reputational overhang can lag return profiles by years, then reemerge when cap tables are reexamined.

His exposure to Bitcoin infrastructure reached deeper. Adam Back confirmed that Epstein was described as a limited partner in Joi Ito’s fund, which later acquired a minority stake in Blockstream. Newly surfaced emails show Back and Blockstream co-founder Austin Hill were invited to Epstein’s island in 2014; it’s unclear if they went. Back has stated Blockstream has no direct or indirect financial connection with Epstein or his estate today. Even so, the association triggered fresh calls this week from a former Bitcoin Core developer for Back to step down—proof that old links can catalyze immediate governance questions.

The files also capture how elite interlocutors shaped the story around Bitcoin. In 2014, Peter Thiel asked Epstein about growing “anti-BTC pressure” inside the U.S. government; Epstein replied that there was little agreement on whether Bitcoin should be viewed as money, property, infrastructure, or a payment system. Back then BTC traded near $691. It has since cycled violently and, more recently, hovered around $70,000 after topping $126,000 last October. The ambiguity Epstein flagged is still a policy reality many agencies wrestle with.

There’s a tax-policy strand too. In 2018, Epstein privately suggested to Steve Bannon that Treasury should roll out a voluntary crypto gains disclosure to “fuck all the bad guys.” Later that year he argued governments should coordinate on crypto the way they did on the early internet—suggesting international agreements and shared frameworks. Whatever one thinks of the messenger, those notes preview ongoing debates around standardized reporting and cross-border enforcement.

Epstein’s house also functioned as a salon for crypto-curious insiders. Emails place a meeting between Brock Pierce and former Harvard President Larry Summers at Epstein’s Manhattan townhouse to talk Bitcoin. Summers reportedly saw opportunity but worried that public losses could damage his reputation—a candid assessment that many legacy figures quietly echoed at the time.

Other messages reveal a darker personal backdrop. After Epstein’s 2008 conviction, Pierce still exchanged emails with him about cryptocurrency and women, at one point writing that he “had a great time with the girls.” Epstein asked Pierce to “find him a present” while he traveled, and he inserted himself into communications around Pierce’s alleged relationship with an individual he called “his assistant,” who allegedly declined a marriage proposal. This is precisely the kind of proximity that can contaminate otherwise legitimate ventures when the past is re-read through today’s standards.

Reputation cuts multiple ways. In 2010, Epstein’s publicist Peggy Siegal called MicroStrategy Executive Chairman Michael Saylor “a creep” in an email, saying he’d paid $25,000 for a spring gala to get his name on the invite and “meet a hip group.” A decade later, Saylor would drive a corporate Bitcoin treasury playbook, with MicroStrategy accumulating nearly $50 billion worth of BTC and inspiring many finance chiefs to study similar strategies. Dismissed figures can become central, and vice versa—another reason founders should design for resilience against narrative whiplash.

Some exchanges in the cache grapple directly with market integrity. In an email to Bitcoin researcher Jeremy Rubin, Epstein wrote that he was “more than happy to fund things” but “as I am high-profile, it can’t be questionable ethics.” Rubin noted there’s a “grey area between pump and develop.” Epstein replied: “Their deal is to pump the currency. It is dangerous.” That tension—between open promotion and manipulative hype—still defines token issuance, market microstructure, and disclosure norms.

There are fringe cameos, too. Investor Masha Drokova emailed Epstein praising a “super smart and young blockchain enthusiast in Russia,” adding he “can be better than Vitalik Buterin if he focuses on technology.” The individual was not named, and it’s unclear if any introduction occurred. These “next Vitalik” pitches tend to surface when capital pools chase edge inside opaque networks.

The lesson across these vignettes is straightforward: in permissionless systems, the social layer is not permissionless. Crypto projects often needed gatekeepers—LPs, publicists, academics, and political operatives—to accelerate adoption. That can work until it doesn’t. Practical steps exist: rigorous LP screening, explicit cap table hygiene, proactive disclosure policies, and crisis communications plans that assume old emails will see daylight. Regulators will likely read these documents as a mandate to tighten reporting and conflicts rules. Builders who stay ahead of that curve usually buy themselves time—time that, in markets like Bitcoin, is often the most valuable asset of all.