Ninjas in Pyjamas Parent Mines $14.5M in Bitcoin, Guides to 140 BTC/Month as Hashrate Ramps

NIP Group (Nasdaq: NIPG) mined 151.4 BTC in three months and now guides to 140 BTC per month, with 9.66 EH/s live and total capacity set to reach 11.3 EH/s this month.

Because Bitcoin

January 15, 2026

An esports brand turning compute into cash flow is no longer a thought experiment. NIP Group, the Nasdaq-listed parent of Ninjas in Pyjamas, says it mined roughly 151.4 BTC—about $14.5 million—in the first three months of its Bitcoin operation (September through November), and is accelerating deployment. The company now guides to approximately 140 BTC per month (around $13.5 million at current prices) once fully online, down from a prior 160 BTC/month target as it tightens assumptions.

The core of the strategy is straightforward: convert equity into hashrate to build a second growth engine alongside entertainment. In November, NIP Group agreed to issue more than 314 million Class A ordinary shares to acquire rigs totaling about 8.19 EH/s from Apex Cyber Capital, Prosperity Oak Holdings, and Noveau Jumpstar. That fleet has since pushed operational capacity to 9.66 EH/s, placing the firm among the top 20 publicly traded Bitcoin miners in the United States and the largest operator in the MENA region. With final tranches closing, management expects to reach roughly 11.3 EH/s later this month.

This is a classic trade: dilution and execution risk today for potential BTC-denominated output tomorrow. The market’s initial read is cautious—the stock recently traded around $1.10 and is roughly 54% lower over six months—yet production is real and scaling. Leadership frames the move as proof they can deploy infrastructure at scale, turning mining into a complementary business line at the intersection of digital assets, compute, and gaming—with optionality to pivot some capacity toward AI workloads if that market continues to mature.

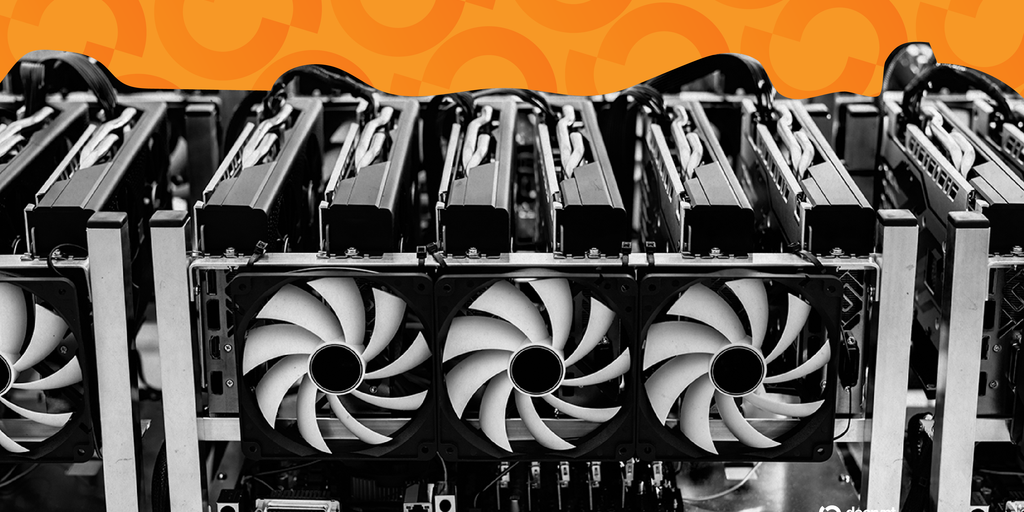

It helps to ground the economics. Bitcoin mining secures the network by having specialized machines perform massive proof-of-work calculations; winners of each block currently receive a 3.125 BTC subsidy (about $303,000) plus transaction fees. The process is energy-intensive, which is why large operators aggregate thousands of rigs in industrial facilities. NIP’s revised 140 BTC/month guide implies a disciplined view of uptime, difficulty, and fee tailwinds. That adjustment from 160 BTC/month reads less like a miss and more like a recalibration as machines come online and real-world performance replaces spreadsheet models.

One decision that will shape investor perception is treasury policy. The company has emphasized growing its Bitcoin holdings and hashrate, while indicating it may sell coins selectively to fund expansion or operations. That creates a deliberate coupling to Bitcoin’s cycle: balance sheet value and cash generation can rise meaningfully in up-markets, but mark-to-market volatility will filter through results. Execution will hinge on energy sourcing, facility reliability, and disciplined hedging—areas where first-time entrants sometimes stumble, though partnerships and regional scale can narrow that gap.

The more interesting angle isn’t whether an esports group can mine; it’s whether an entertainment brand can re-rate as a compute company without losing the equity story investors originally bought. If NIP demonstrates steady 9.66–11.3 EH/s performance, transparent coin management, and sensible capital costs after issuing 314 million new shares, the narrative can shift from “pivot risk” to “operating leverage.” If not, the equity-for-hashrate bet could feel expensive in hindsight.

NIP first flagged its mining entry last July and began production in 2025. Since then, the company has methodically added rigs, mined $14.5 million worth of BTC across its first three months, and is now targeting consistent monthly output near 140 BTC. Ninjas in Pyjamas continues to compete at the top levels in Counter-Strike 2, Valorant, League of Legends, and Rocket League. For holders, the question isn’t whether this is adjacent to gaming; it’s whether the Bitcoin flywheel—hashrate growth, coin accumulation, selective sales—can compound faster than the dilution and operating complexity it introduces.