After Bitcoin’s 47% Slide, Novogratz Says Tokenization Era Will Temper Crypto Returns

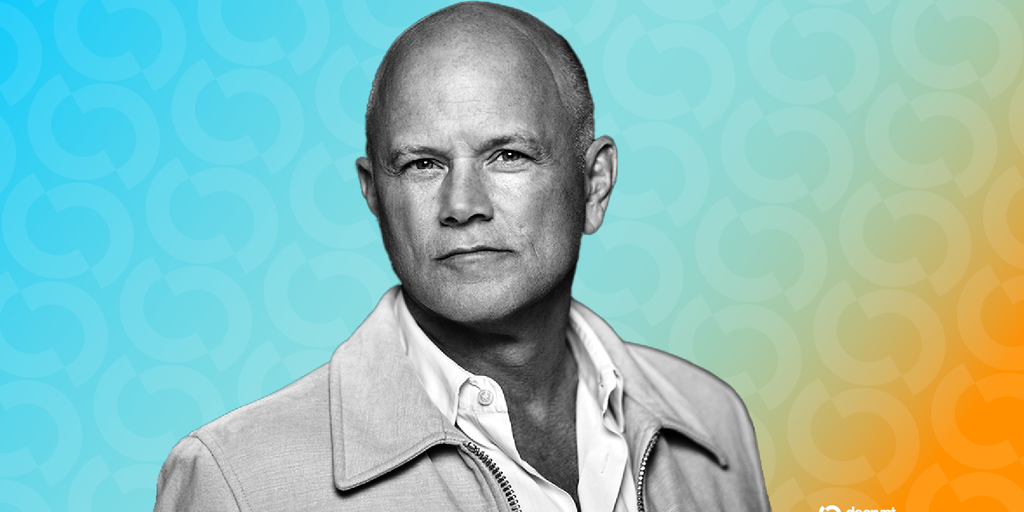

Galaxy’s Mike Novogratz says crypto is shifting from hype to tokenized real-world assets, implying lower—but steadier—returns. Inside his new $100M hybrid crypto fund.

Because Bitcoin

February 11, 2026

Bitcoin’s sharp reset has a narrator. Mike Novogratz argues the high-octane, speculation-led chapter is fading, and a utility-first cycle—built on tokenizing real-world assets (RWA)—is taking the stage with lower return expectations.

In a Tuesday CNBC interview, the Galaxy CEO said the market that rewarded narrative momentum is giving way to using “crypto rails” to deliver banking and financial services globally. That means tokenizing off-chain assets—equities, bonds, and more—onto blockchains, where return profiles are anchored by the cash flows and regulatory constraints of traditional markets, not meme-driven reflexivity.

His timing follows a bruising sequence. Bitcoin has fallen more than 47% from October’s record above $126,000 to roughly $66,551, dipping near $60,000 last week. Over the last seven days, BTC slid about 10%, with Ethereum tracking a similar decline, while XRP and Solana posted steeper losses. Novogratz linked today’s mood to two scars: the November 2022 FTX bankruptcy drawdown and an October 2025 flash crash that erased $19 billion in crypto derivatives positions. Unlike FTX, the 2025 event lacked a single villain—yet it still expelled participants and frayed confidence. In a market where stories recruit capital, a mass liquidation sets back the storytelling clock; rebuilding takes time.

He is not stepping away from the asset class—he’s changing the playbook. Galaxy is rolling out a $100 million hedge fund before the end of March that caps direct token exposure at up to 30%, with the balance in financial services equities expected to benefit as digital asset technology and regulation advance, per a Financial Times report. That 30/70 split is a tell: crypto beta remains in the mix, but he sees the more durable compounding in rails, infrastructure, and regulated adjacency.

Here’s the crux of his thesis—and where I largely agree. Tokenization compresses excess returns because it imports price discovery, disclosure, and arbitrage from traditional markets. When a bond or stock lives on-chain, the upside is bounded by its fundamental yield and growth; the premium shifts to efficiency—settlement speed, collateral mobility, 24/7 markets—not to speculative convexity. That tends to lift Sharpe ratios while capping nominal gains. Traders accustomed to 10x arcs will need to adapt toward carry, basis, and credit-like strategies, where edge comes from execution, data, and compliance fluency rather than narrative virality.

There are second-order effects worth flagging:

- Market structure: Liquidity migrates from momentum-driven alt cycles to tokenized cash instruments, treasuries, and equities, tightening spreads and dampening volatility in core venues while creating new niches in on-chain credit and repo. - Business model rotation: Exchanges, brokers, and custodians that lean into KYC’d RWA settlement, regulated listings, and tokenized corporate actions will outgrow pure altcoin throughput models. The equity sleeve in Galaxy’s fund is a direct bet on that winner’s circle. - Investor psychology: After a $19 billion derivatives flush, risk budgets shrink and time horizons lengthen. Narrative rebuilds happen, but they compete with yield-bearing on-chain instruments that offer clarity and auditability. - Risk ethics: As finance migrates on-chain, disclosures, rehypothecation practices, and oracle integrity matter more than eye-catching APYs. Opaque leverage in a tokenized wrapper is still opaque leverage.

None of this implies crypto’s upside is gone. It argues the locus of return is changing. Infrastructure, compliance software, data, and settlement middleware can accrue durable value. Select tokens with real fee capture and defensible moats still warrant exposure—just less as a lottery ticket, more as a cash-flowing asset in a portfolio alongside equities shaped by the same rails.

Novogratz is effectively codifying that stance: stay long the rails, keep measured crypto beta, and position for policy and product convergence. If he’s right, the trade ahead is less about chasing blow-off tops and more about owning the plumbing—and getting paid, steadily, as it moves trillions.