Thailand Seizes $8.6M in Bitcoin Rigs as Scam Networks Turn Mining Into a Laundering Engine

Thai authorities seized 3,642 Bitcoin rigs worth $8.6M tied to Myanmar-based scam franchises, exposing how illegal mining turns stolen power and fresh coins into a resilient laundering stack.

Because Bitcoin

December 4, 2025

Thailand’s latest crypto bust wasn’t about hashpower; it was about cashflow. Investigators seized $8.6 million (300 million baht) in Bitcoin mining equipment from seven sites suspected of funding transnational scam franchises operating from Myanmar—highlighting how illegal mining has become the financial spine, not a side hustle, of these syndicates.

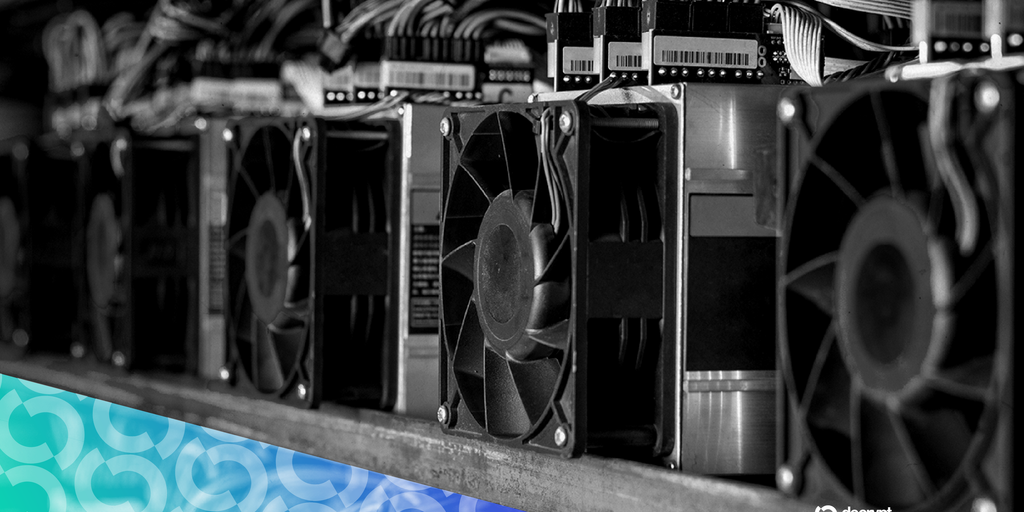

What was found - Raids hit six locations in Samut Sakhon and one in Uthai Thani on Tuesday. - Authorities impounded 3,642 ASICs valued at $7.7 million (270 million baht) plus electrical gear worth $860,000 (30 million baht). - Many machines sat in soundproof, containerized units with water cooling—portable, quiet, hard to spot. - Investigators traced the operations to Myanmar-based “Chinese” scam networks with flows exceeding $143 million (5 billion baht) and requested assistance from Beijing.

The pivot to “clean hash” The strategic shift matters: mining converts stolen electricity and illicit fiat into newly minted Bitcoin—fresh UTXOs with no transactional history. Syndicates push “dirty money into rigs,” then sell block rewards or pool payouts through shell firms and nominee directors. Because issuance coins originate at the coinbase and payouts often route through pools, provenance gets murky fast, especially when miners hop jurisdictions and play liquidity across OTC desks with weak AML.

This is why detection trails run cold. Unless pools enforce KYM (Know Your Miner) and regulators align import, power, and corporate registries, tracing the capital stack from scam compounds to ASIC farms remains slow, giving networks time to redeploy hardware.

A franchise model, not a silo Cybercrime consultant David Sehyeon Baek characterizes these groups as a regional franchise: capital may start with Chinese networks, but operations stretch across Myanmar, Cambodia, Laos, Thailand, and beyond. The same actors behind forced-labor scam compounds are sinking money into physical infrastructure—data centers, compounds, and mines—because fixed assets stabilize revenue, diversify risk, and complicate enforcement.

Regional pressure is rising - Malaysia’s utility TNB estimates illegal mining drained roughly $1.1 billion (RM4.57 billion) in electricity over five years. - Authorities there now use thermal drones and handheld sensors; miners counter with heat shields and CCTV. - In May, cases tied to crypto power theft reportedly jumped 300%; police seized 45 machines worth $52,145 (RM225,000) that were stealing about $8,342 (RM36,000) in electricity monthly. - In April, the UN Office on Drugs and Crime warned illegal mining is becoming a powerful laundering tool for East and Southeast Asian crime groups; last month Interpol elevated scam-compound networks to a transnational criminal threat.

Global response is coordinating In the U.S., the Attorney for D.C., Jeanine Pirro, launched the Scam Center Strike Force to target crypto scams linked to organized Chinese syndicates. That matters less for asset seizures in Thailand than for squeezing offramps and service providers that touch these coins.

What will actually move the needle - Economics: Seizures need to impair ROI, not just confiscate boxes. If the rigs relocate faster than cases progress, the model holds. - Infrastructure controls: Link power anomalies, industrial leases, and ASIC imports to corporate registries to surface shell chains. Energy-theft analytics should be treated like on-chain surveillance—continuous and automated. - Pool-level policy: KYM, payout allowlists, and jurisdictional filters will raise friction. The trade-off: stricter pools improve traceability but push bad actors toward private pools or solo mining. - Protocol nuance: As adoption of Stratum v2 and job negotiation grows, attribution to individual miners could get trickier. Regulators need to understand how payout architectures shape traceability, not just addresses on a screen.

Expect dispersion, not disappearance. As Baek notes, rigs will migrate to remoter grids or hop borders the way scam compounds did. The contest is no longer between police and miners—it’s between data-driven disruption of a franchise supply chain and a highly mobile, containerized compute business that already assumes churn as a cost of doing business.