Winter Storm Triggers U.S. Mining Curtailments, Underscoring Bitcoin’s Role as a Grid‑Flexible Load

An Arctic blast pushed U.S. miners to throttle power use, widening block intervals as Foundry, Luxor, and Antpool trimmed hashrate before partially rebounding.

Because Bitcoin

January 26, 2026

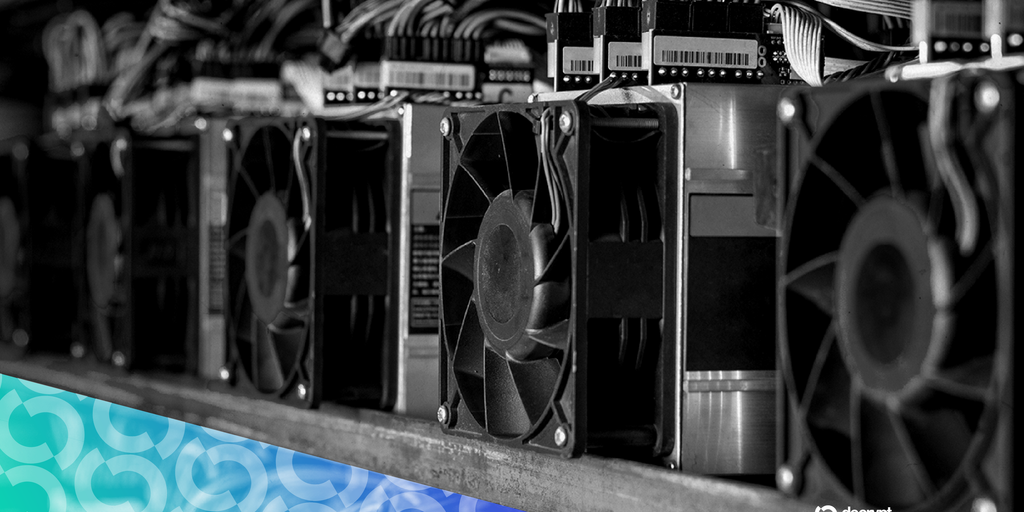

A deep freeze across the central and eastern United States didn’t just tighten power markets—it briefly slowed the engine room of Bitcoin. As grid stress mounted, several U.S.-exposed mining pools curtailed power, block intervals widened, and network hashrate dipped before stabilizing.

Public data shows the clearest drawdown at pools with heavy U.S. footprint. Foundry USA’s hashrate slid from about 260 EH/s on January 24 to roughly 124 EH/s the next day, recovering toward 134 EH/s by Monday. Luxor followed a similar pattern, easing from around 40 EH/s to about 16 EH/s by Monday. Antpool, which has U.S. exposure via a joint venture with Applied Digital, declined from approximately 165 EH/s to near 137 EH/s at press time. Other pools softened too, but the concentration of U.S. operations made the storm’s imprint most visible there. Industry outlet TheMinerMag was early to flag the shifts.

Why the throttle matters is less about a winter headline and more about how Bitcoin’s infrastructure now behaves as a grid-interactive asset. In extreme weather, miners often face a simple calculus: when prices spike or operators request curtailments, turning down rigs protects balance sheets and helps stabilize local systems. That response temporarily lifts block times, but the network’s global distribution and difficulty adjustment tend to absorb the variance.

Executives in the space framed this week as routine stress management rather than a shock. Fakhul Miah of GoMining Institutional pointed to weather, power pricing, maintenance cycles, and localized grid conditions as recurring drivers of short-term fluctuations—effects that the protocol’s difficulty mechanism is designed to smooth over. Callan Sarre at Threshold Labs emphasized that when concentrated U.S. hashrate steps back, intervals widen and then drift back toward baseline, illustrating that the consensus layer keeps operating as intended.

The deeper story is miners’ evolution into flexible, dispatchable load. Nowhere is that clearer than in markets like Texas, where curtailment has become part of the operating playbook: ramp down when residential demand surges, earn demand-response revenue for helping balance the grid, then ramp back up as conditions normalize. For operators, this isn’t charity; it’s a revenue stack and a risk hedge against power price volatility. For communities, it can reduce the need for emergency measures during cold snaps, prioritizing households without compromising network security.

There are trade-offs. A sizable share of hashrate tied to one geography means weather can leave measurable fingerprints on block production, even if briefly. Investors and policymakers watching the sector tend to focus on price charts, yet the more material variables here are capacity procurement, curtailment contracts, and regional exposure. The firms that win in this regime are likely those that engineer for rapid ramp cycles, secure favorable interconnection agreements, and treat flexibility as core infrastructure—not an edge case.

Technically, the protocol did what it usually does under stress: accommodate a temporary hash supply shock and keep blocks coming, albeit at a slower cadence until miners rejoined. Operationally, miners leaned on playbooks that are now common: participate in demand-response, avoid peak pricing, protect hardware from extreme ambient conditions, and spin back as soon as the grid loosens. Ethically, prioritizing residential and critical loads during a cold wave reinforces the industry’s social license, which still matters for siting and policy.

This storm won’t define the cycle. It does, however, reinforce a structural shift: Bitcoin mining increasingly functions as a grid asset that can turn down in minutes without losing its core economic purpose. If you’re modeling miner performance, track not only bitcoin price and difficulty, but also the cadence of curtailment events, ancillary service revenues, and how much of a fleet sits in weather‑sensitive zones. That’s where the real signal showed up this week.